How Much Is Too Much College Debt?

How Much College Debt Is Too Much?

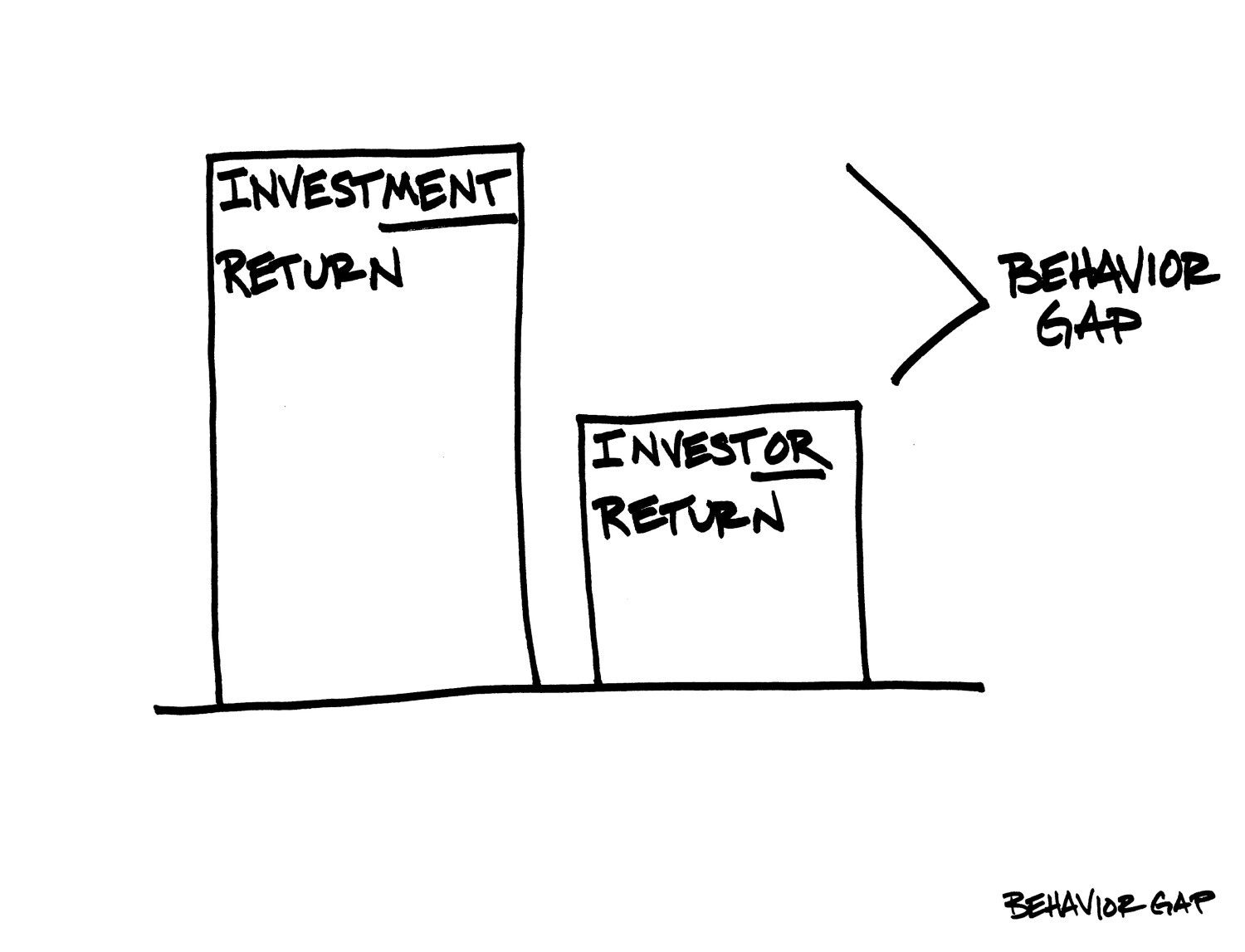

Why Average Investors Don’t Beat the Market

Focusing on returns isn’t necessarily a sound investment strategy — and it could be part of what leads average investors to perform so poorly.

Make Room for Your Passion in Your Life and Your Budget

Most of us have something that we absolutely love to do. But life often gets in the way of that passion.

Why Your Retirement Is More Important Than Saving for College

Yes, it sounds harsh. But this is an important financial reality to understand: you should prioritize your retirement savings over saving for your kids’ college expenses.

Make the Most of Your Vacations: Save for Travel, Not a Vacation Home

It’s well worth understanding how to make the most of your vacations, you’re better off saving your money for trips, experiences, and various destinations — not a second home.

Budgeting for Coffee Sucks, Try This Instead

Trying to cut back on your spending gets tedious when you focus on minute details. Yes, it’s important to track every dollar — but to feel anxious about spending on small purchases that you value because you’re trying to save more and spend less?

In Times of Change, Focus on Your Financial Plan

No one can guarantee when the markets will go up or down. Lots of talking heads and so-called “experts” like to claim they know when factors like news items or current events will impact how the stock market behaves, but it’s all guesswork.

Ready to invest in real estate? Take a close look at your margins

Is buying investment property a wise idea? Is it the best way to build wealth? Is rental property really ‘risk averse’?

Generation X? I feel your pain!

Generation X has some problems—and not just their own. Perhaps the biggest one of all is that this group has everyone else’s problems too!

Is “breaking news” killing your financial plan?

The fact is, all that financial “news” means absolutely nothing to the normal investor. Sure, the play-by-play changes in the stock market may make a difference to the day traders—at least for the day. And yes, the clicks on CNN’s website will make a difference to some marketing genius’s commission check. But for anyone investing for the long term, none of it matters. It’s just noise.