Net Worth Summaries vs Portfolio Reporting

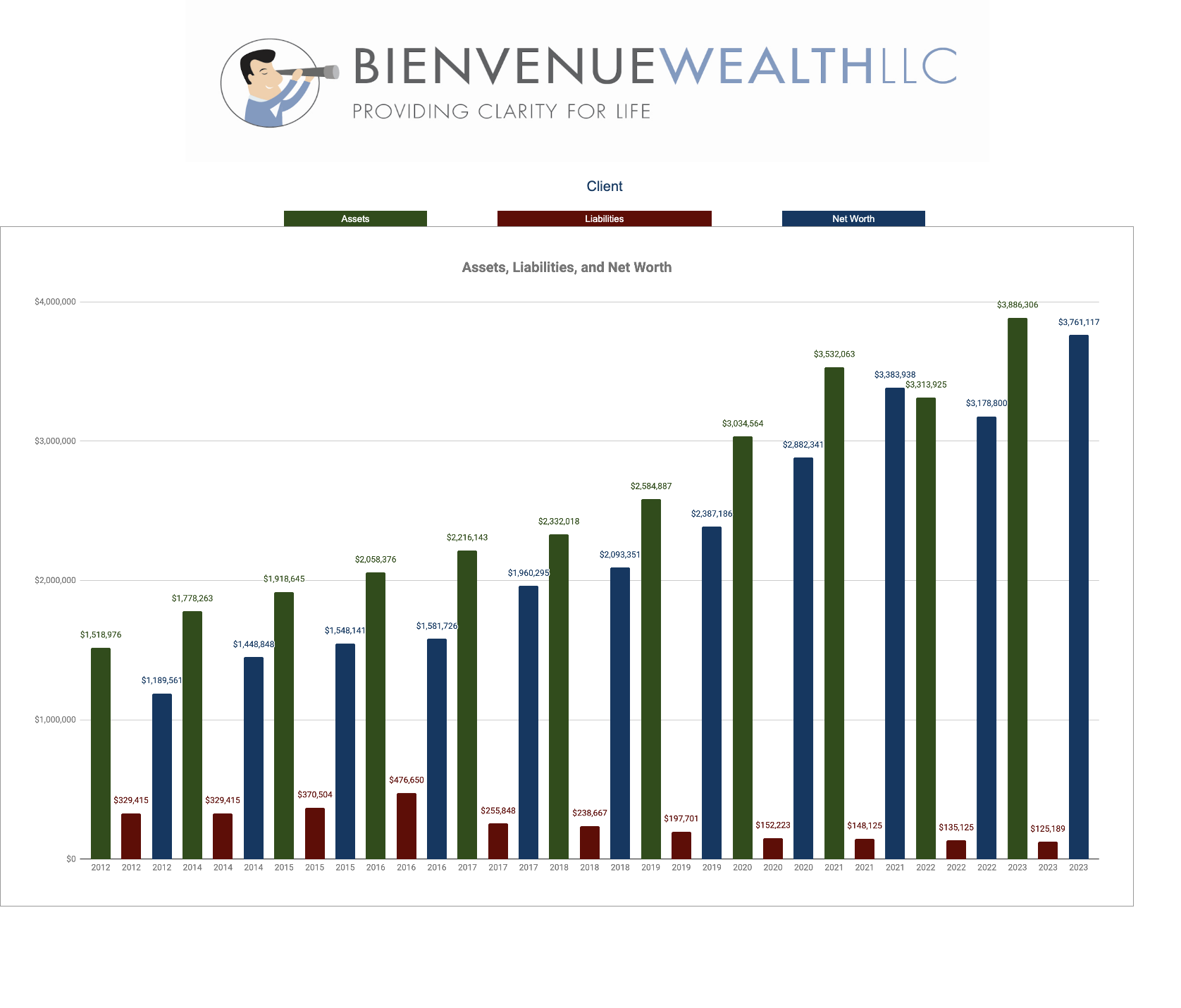

At this time of year, we shift our focus to something truly fascinating – the net worth summaries of our valued clients. It never ceases to amaze us as we delve into the diverse range of net worth returns from one family to another. How is it possible that the 2023 net worth outcomes for over 65 families, all with similar portfolios, exhibit a staggering 60% variation year over year? Now, you might be curious about why Bienvenue Wealth places such significance on net worth summaries rather than the typical portfolio performance reporting. Well, here’s the heart of the matter – your family’s portfolio is more than just numbers on a page; it’s the fuel propelling your life’s plan. While the financial aspect is undeniably vital, it’s just a piece of the grand puzzle. Successful investors are those who consistently act on a thoughtfully crafted plan, steering their ship through…

What Financial Professionals Should You Have on Your Money Dream Team?

By working with the right financial experts, you can gain peace of mind, maximize your savings, and better achieve your financial goals.

5 Important Retirement Savings Milestones to Reach In Your 50s

When you’re just a few short years away from retirement, there are some exciting milestones to prepare for. Now’s the time to buckle down and think about what you want your retirement to look like and how your savings strategy can help make it happen. Below we’ve identified five savings milestones you should address as you move closer to your dream retirement. Milestone #1: Determine How Much You Need to Save At this point, you may have a general idea of how much to save for retirement. As you near the final stretch, now’s the time to dig in and decide how much you need to save up before leaving your 9-to-5 job for good. Start by considering what your ideal retirement will look like. Your retirement lifestyle plan will help you determine how much you’ll likely be spending in retirement. In other words, your retirement lifestyle plan will directly…

Is Cash Always King?

Determining the right amount of cash to keep on hand is a subject ripe for debate. Is cash trash, or is cash king? It’s not a one size fits all answer, click here to see what we think.

How Gen X Can Start Off 2021 On Good Financial Footing

Today, we’re going to look at the top ways the generation that wears many hats can prioritize their financial wellbeing in the new year.

Why You Should Sell Your Vacation Home

If you’re still working to build wealth, you should sell your vacation dream home and use the money to work for your family.

Teach Your Kids Early About The Value of Money

Walking kids through your financial decisions will allow them to begin to see the light. Starting these lessons early gives them a gift that will pay dividends (and interest) for the rest of their lives.

A Little Relaxation and Vacation Can Get You Back on Track

Vacations are something we all deserve, and the benefits are boundless.

Career Change and Pocket Change: Financial Advice for Career Shifters

If you are considering a career change make sure you are thoroughly weighing all of the pros and cons.

Managing Kids’ Tech Use

Just because your kid is a digital native doesn’t mean that she or he possesses the knowledge or maturity to navigate this online environment in a way that is healthy.