Net Worth Summaries vs Portfolio Reporting

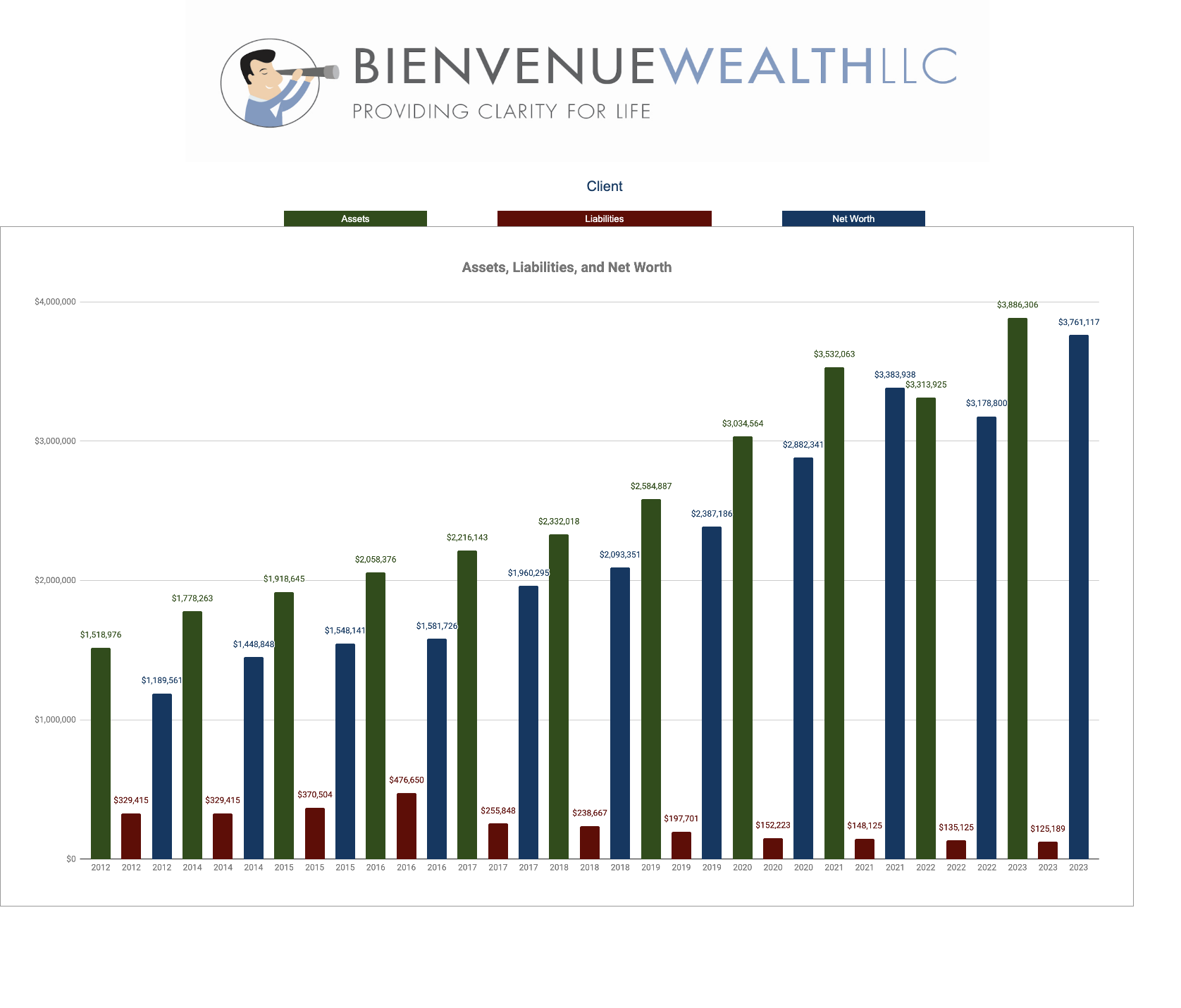

At this time of year, we shift our focus to something truly fascinating – the net worth summaries of our valued clients. It never ceases to amaze us as we delve into the diverse range of net worth returns from one family to another. How is it possible that the 2023 net worth outcomes for over 65 families, all with similar portfolios, exhibit a staggering 60% variation year over year? Now, you might be curious about why Bienvenue Wealth places such significance on net worth summaries rather than the typical portfolio performance reporting. Well, here’s the heart of the matter – your family’s portfolio is more than just numbers on a page; it’s the fuel propelling your life’s plan. While the financial aspect is undeniably vital, it’s just a piece of the grand puzzle. Successful investors are those who consistently act on a thoughtfully crafted plan, steering their ship through…

Retirement Living in New Orleans: Exploring the Best Neighborhoods

New Orleans is a spirited city with no lack of energy, culture, and excitement. But did you know it’s also a great place to call “home” in retirement? With such diverse neighborhoods, you can find the perfect living space to support the retirement lifestyle you’ve always envisioned. In this article, we’re exploring some of New Orleans’s top neighborhoods and what makes them ideal for those considering relocating here in retirement. The French Quarter: Historic Charm and Entertainment Few neighborhoods are more famous in the country than the French Quarter—and for good reason. This iconic area is the epitome of good food and unparalleled nightlife. For retirees seeking a lively and culturally rich atmosphere, few places in New Orleans are better suited for you than the French Quarter. From the instantly recognizable cast iron balconies to the cathedrals and colorful townhouses, just the architecture alone is enough to take your breath…

The Retirees Guide to New Orleans: Exploring the Vibrant Culture, Cuisine, and Community

Thinking of retiring to New Orleans? If this city is on your radar, you may already know why it’s a fantastic retirement destination. If you haven’t considered New Orleans, now is the time! There’s much to say about The Big Easy, from the culture to the cuisine to the community. Read on to discover why New Orleans is an excellent place for retirees. The Rich Cultural Heritage of New Orleans New Orleans is a city rich in history. You’ve heard of Mardi Gras, but did you know that the name of the celebration comes from Native Americans? The indigenous people of New Orleans, otherwise known as Mardi Gras Indians, were composed of over 40 tribes. These tribes helped shield runaway slaves in the 1800s, and this friendship between the two groups greatly informed Mardi Gras Indian culture. However, these weren’t the only groups that influenced New Orleans culture; there were…

What Financial Professionals Should You Have on Your Money Dream Team?

By working with the right financial experts, you can gain peace of mind, maximize your savings, and better achieve your financial goals.

5 Important Retirement Savings Milestones to Reach In Your 50s

When you’re just a few short years away from retirement, there are some exciting milestones to prepare for. Now’s the time to buckle down and think about what you want your retirement to look like and how your savings strategy can help make it happen. Below we’ve identified five savings milestones you should address as you move closer to your dream retirement. Milestone #1: Determine How Much You Need to Save At this point, you may have a general idea of how much to save for retirement. As you near the final stretch, now’s the time to dig in and decide how much you need to save up before leaving your 9-to-5 job for good. Start by considering what your ideal retirement will look like. Your retirement lifestyle plan will help you determine how much you’ll likely be spending in retirement. In other words, your retirement lifestyle plan will directly…

How Gen X Can Balance Making Big Purchases Without Adding Bad Debt

Surprisingly enough, not all debt is created equal. With so many options, Gen Xers must know how to make purchases without adding bad debt.

7 Reasons Why You Should Focus Your Retirement Planning to New Orleans

If you’ve thought about moving in retirement, your list of potential locations is likely long. Your options are virtually endless without the limitations of a nine-to-five job or kids at home. But if you’re looking for somewhere warm, inviting, and full of life, you can’t go wrong with a city like New Orleans. Here’s a look at the top seven reasons why you should focus your retirement planning efforts on The Big Easy. Reason #1: Tax-Friendly Laws New Orleans is a particularly tax-friendly city for seniors, as it offers several notable tax breaks for those in retirement. Not to mention, Louisiana has the fifth lowest property taxes in the country, which is excellent news for those planning on buying a home in retirement. In general, Louisiana’s state taxes are considered to be lower than the national average. The income tax rates for Louisiana residents range from 1.85% to 4.25% —…

5 Ways Your New Orleans CFP Can Help You Maximize Your Tax Refund

After the revelry of the Mardi Gras subsides, it’s time to turn your attention toward something less festive: tax season. However you feel going into it, everyone has the same goal: maximize my refund and minimize my tax liability. If you haven’t thought much about your taxes, or have yet to create a tax savings strategy, below are a few considerations to make. Plus, we offer five tips for managing that refund once it comes your way. What to Know About Louisiana State Taxes If you’ve recently moved to Louisiana or simply never put much thought into your state taxes, here’s a quick assessment of Louisana’s taxes. The individual income tax is on a graduated scale, ranging from 1.85% to 4.25%. If you’re a business owner, your company may also be subject to corporate income tax, which ranges from 3.5% to 7.5%.1 The state sales tax rate is 4.45%. The…

How A Louisiana 529 Plan Can Help You Maximize Your College Savings

You’re not alone if the thought of a college education’s price tag makes you sweat. In 1980, the annual cost of a 4-year college (including tuition, room and board, and other fees) was $10,231. In 2020, that price took a 180% jump to $28,775. And that’s just for public institutions! If your child dreams of attending a private school, the average price is $48,965. But have no fear, Louisiana residents! A Louisiana 529 Plan can help you maximize your college savings so you can use your hard-earned dollars in the best way possible. Ready to see how a Louisiana 529 Plan can help you save for college? What Is A 529 Plan? A 529 Plan is a savings plan with tax advantages designed to help pay for educational costs. There are two major types: Any funds saved through an Education Savings Plan grow tax-deferred. And as a bonus, as long…

How To Create a Retirement Lifestyle Plan That You and Your Spouse Love

As retirement draws nearer, you and your spouse might start daydreaming about mornings without alarm clocks, vacations at the drop of a hat, or days spent lounging in the sunroom with a bottle of wine. Retirement sure has a lot to offer, but creating the retirement of your dreams does require some planning and preparing — both mentally and financially. That’s where a retirement lifestyle plan comes into play. Here’s what a lifestyle plan is, and how you can start building one that reflects your retirement goals and wishes. I Have a Financial Retirement Plan, Why Do I Need a Lifestyle Plan? When spending so much time and energy saving for retirement, sometimes people forget that, in reality, money isn’t the goal. Sure, you have an idea in your head of how much you need to retire comfortably. But have you put much thought into what “retiring comfortably” actually means…