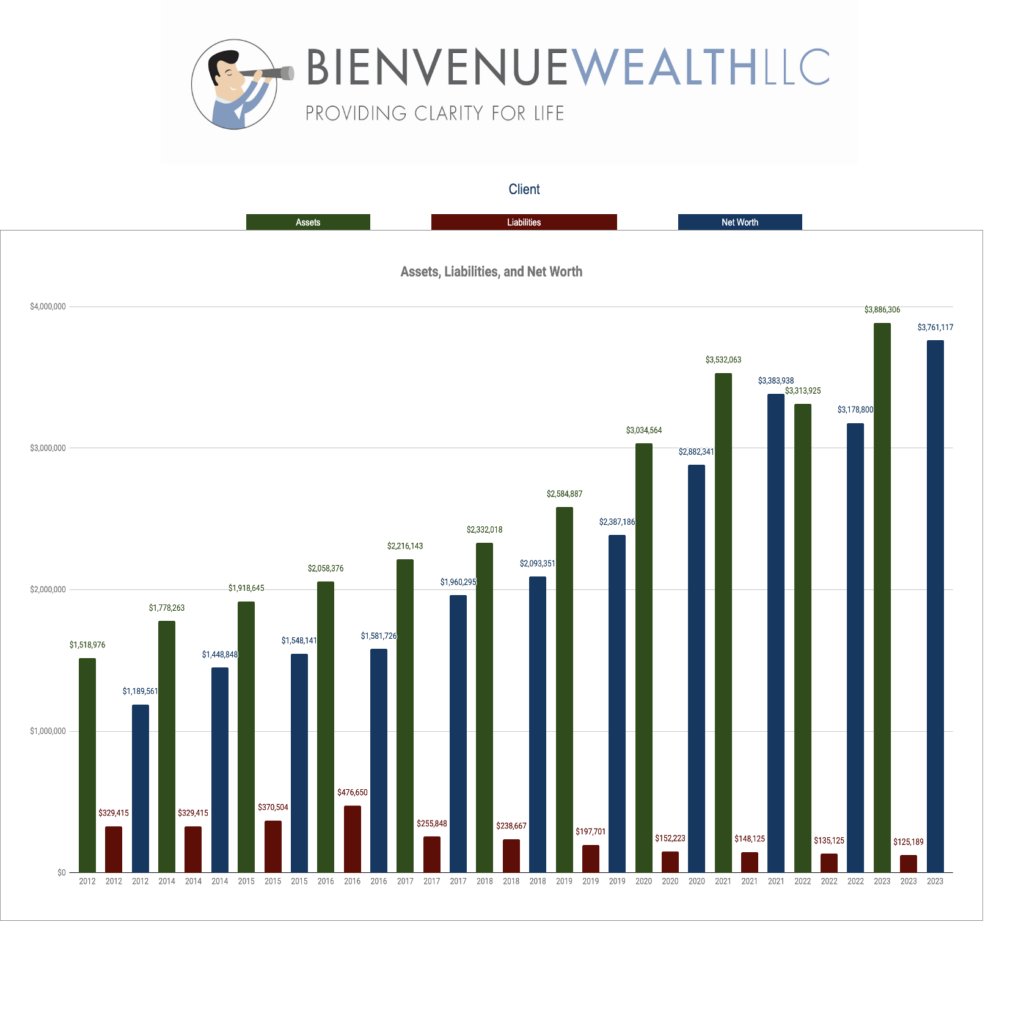

At this time of year, we shift our focus to something truly fascinating – the net worth summaries of our valued clients. It never ceases to amaze us as we delve into the diverse range of net worth returns from one family to another. How is it possible that the 2023 net worth outcomes for over 65 families, all with similar portfolios, exhibit a staggering 60% variation year over year?

Now, you might be curious about why Bienvenue Wealth places such significance on net worth summaries rather than the typical portfolio performance reporting. Well, here’s the heart of the matter – your family’s portfolio is more than just numbers on a page; it’s the fuel propelling your life’s plan. While the financial aspect is undeniably vital, it’s just a piece of the grand puzzle. Successful investors are those who consistently act on a thoughtfully crafted plan, steering their ship through calm and stormy seas alike. On the flip side, those who struggle often find themselves reacting to the whims of the market.

When individuals prioritize ‘investments’ over the ‘plan,’ things can take an unexpected turn. The reality is, we possess minimal control over portfolio outcomes in the short term. To navigate this, we ‘manage’ portfolio outcomes by making appropriate investments and ‘spread the wealth’ through diversification with various types of investments. Annually, we rebalance portfolios to realign your investment mix with your goals, and then we’re prepared for the challenges of the upcoming year. Investing isn’t trading, it’s counter-intuitive!

Net worth planning is behavioral and centers on what we can control. This form of life planning surpasses the pursuit of investment returns. Clients who adhere to a financial plan and concentrate on manageable inputs will reap rewards over extended periods. Success in investing hinges on goals and planning. Conversely, failed investing fixates on the market and performance. If your net worth seems stagnant, and the reasons elude you, here are a few points to ponder.

Savings Habits:

Have you saved first and then spent what is left? Savings rates are an influential part of your plan. Resistance against saving is your #1 enemy.

Wealth Distribution vs. Accumulation:

Are you distributing wealth when you should be accumulating? If your family can’t live within their own means while earning income, how will you be able to live within your means once the income dries up?

Emergency Fund Considerations:

Oversized emergency funds hinder growth of your net worth. The ‘sleep at night factor’ is important but comes with a cost. Overfunding an emergency fund is a drag on your net worth. Your portfolio is already loaded with multiple types of bonds of varying maturities.

Missed Opportunities:

Gifts, inheritances, scholarships and other windfalls are great chances to solidify your plan and make up for prior deficiencies. We frequently see siblings take divergent paths here that make huge differences over their lifetimes.

Clamoring to Illiquidity and Complexity:

Affinity for illiquidity and complexity is a drag on your family’s net worth. This form of avoidance may go unnoticed for years, but eventually, the complexity and perceived stability of illiquidity will complicate distributions and the estate planning stage.

And the list continues… It’s essential to concentrate on the present and take proactive steps to strengthen your family’s financial plan. By focusing on variables that you can change now vs chasing investment returns, you pave the way for a more secure and stable future.