Net Worth Summaries vs Portfolio Reporting

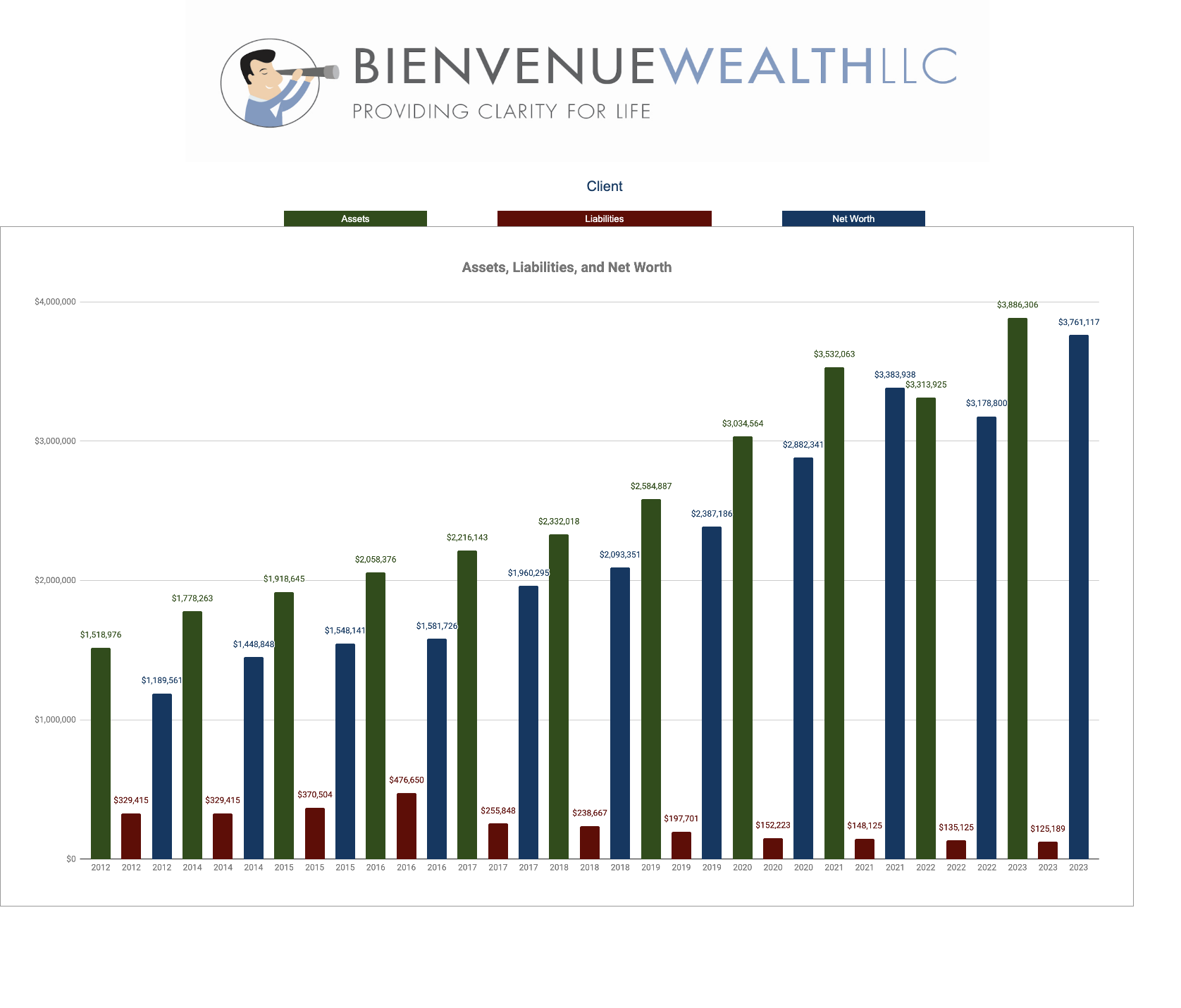

At this time of year, we shift our focus to something truly fascinating – the net worth summaries of our valued clients. It never ceases to amaze us as we delve into the diverse range of net worth returns from one family to another. How is it possible that the 2023 net worth outcomes for over 65 families, all with similar portfolios, exhibit a staggering 60% variation year over year? Now, you might be curious about why Bienvenue Wealth places such significance on net worth summaries rather than the typical portfolio performance reporting. Well, here’s the heart of the matter – your family’s portfolio is more than just numbers on a page; it’s the fuel propelling your life’s plan. While the financial aspect is undeniably vital, it’s just a piece of the grand puzzle. Successful investors are those who consistently act on a thoughtfully crafted plan, steering their ship through…

5 Important Retirement Savings Milestones to Reach In Your 50s

When you’re just a few short years away from retirement, there are some exciting milestones to prepare for. Now’s the time to buckle down and think about what you want your retirement to look like and how your savings strategy can help make it happen. Below we’ve identified five savings milestones you should address as you move closer to your dream retirement. Milestone #1: Determine How Much You Need to Save At this point, you may have a general idea of how much to save for retirement. As you near the final stretch, now’s the time to dig in and decide how much you need to save up before leaving your 9-to-5 job for good. Start by considering what your ideal retirement will look like. Your retirement lifestyle plan will help you determine how much you’ll likely be spending in retirement. In other words, your retirement lifestyle plan will directly…

5 Ways Your New Orleans CFP Can Help You Maximize Your Tax Refund

After the revelry of the Mardi Gras subsides, it’s time to turn your attention toward something less festive: tax season. However you feel going into it, everyone has the same goal: maximize my refund and minimize my tax liability. If you haven’t thought much about your taxes, or have yet to create a tax savings strategy, below are a few considerations to make. Plus, we offer five tips for managing that refund once it comes your way. What to Know About Louisiana State Taxes If you’ve recently moved to Louisiana or simply never put much thought into your state taxes, here’s a quick assessment of Louisana’s taxes. The individual income tax is on a graduated scale, ranging from 1.85% to 4.25%. If you’re a business owner, your company may also be subject to corporate income tax, which ranges from 3.5% to 7.5%.1 The state sales tax rate is 4.45%. The…

What’s A Usufruct? What Louisiana Residents Need To Know

A usufruct permits a temporary use and benefit of someone else’s property. What should Louisiana residents understand about usufructs?

Personal and Business Dollars: Why The Two Are So Drastically Different

The difference between your personal financial plan and your business financial strategy should be significant.

Top Year-End Money Tips To Keep Your Finances From Turning Into A Pumpkin at Midnight

A new year often comes with optimism and an opportunity for a fresh start. It brings a chance to reflect on your finances and make plans.

6 Effective Ways To Build Wealth In Your 50s

At this stage of your life, no financial decision can be taken lightly. Here are six ways to build wealth in your 50s and put yourself on the path to reach your goals.

Are You Making The Most of Your Benefits Package? 4 Clear Ways To Tell

When exploring a new job opportunity, your mind may instantly evaluate your salary and future earning potential.

How To Completely Master Your Equity Compensation: Exploring NQDC Plans

In our last post, we reviewed the intricacies of Restricted Stock Units (RSUs). In part two of our mastering equity compensation series, we jump into the world of NQDC plans. Nonqualified deferred compensation plans (NQDC) are a type of employee retention benefit that allows certain employees to defer a portion of their pay until a later date. You might be asking yourself, why on earth would I do that? If you are earning more than $200,000, you should consider investment options over and above your typical 401(k). Since a 401(k) is limited to $19,500/year(2021) contribution, a high earner will only be able to defer a small fraction of their pay. NQDC plans are perhaps a perfect example of delayed gratification. These plans allow an employee to earn benefits (i.e., cash, bonuses, wages, equity compensation) from their employer in one year and receive the income in another. The best part? The taxes…

Want To Become A Better Investor? Fix These 5 Common Mistakes

Investing is essential to building wealth. Here are the top investing mistakes we see Gen X families make, and how to avoid them.