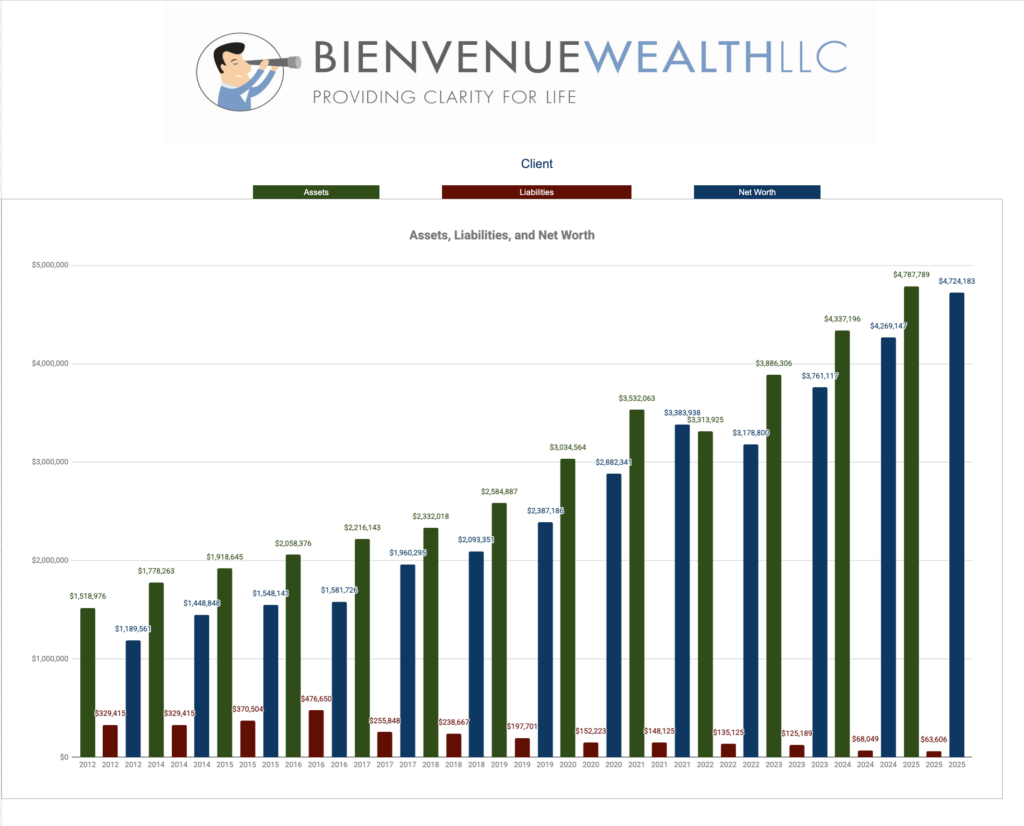

As we review annual net worth summaries, one trend remains consistent year after year: families with similar investment returns often experience vastly different net worth outcomes—in 2025 we have seen ranges varying by as much as 60%! This discrepancy proves that investment performance is only one piece of the puzzle.

At Bienvenue Wealth, we prioritize net worth summaries over standard performance reporting because your portfolio is simply the fuel for your life’s plan, not the plan itself.

When you prioritize “investments” over “the plan,” outcomes become less predictable. In the short term, we have very limited control over portfolio returns. What we can do is:

- Build appropriate portfolios

- Diversify across asset classes

- Rebalance regularly to keep your investments aligned with your goals

That’s investing. It’s deliberate, consistent, and often counter-intuitive compared to what you see in the financial media.

Net Worth Planning: Focus on What You Can Control

Net worth planning is behavioral. It’s about the decisions you make day in and day out. Growing your net worth is what financial planning is ultimately about. If your investments are up, but your net worth is flat or down, it’s worth asking: What could I have done differently this year? The most successful clients are the ones who follow a plan and focus on controllable inputs—savings, spending, debt, risk, and goals. Over time, this matters far more than any single year’s market return.

If your net worth feels stuck and you’re not sure why, here are common issues we see again and again:

1. Savings Habits

- Do you save first and spend what’s left—or the other way around?

- Your savings rate is one of the most powerful levers in your plan.

- Resistance to saving is often the #1 enemy of net worth growth.

2. Wealth Distribution vs. Accumulation

- Are you spending like you’re in the distribution phase when you’re still earning?

- If you can’t live within your means during your working years, it will be even harder once paychecks stop.

- Lifestyle creep is a quiet but powerful drag on long-term net worth.

3. Emergency Fund Balance

- An emergency fund is essential—but too much cash can hold you back.

- Oversized cash reserves may feel safe, but they can significantly slow net worth growth.

- Often, your portfolio already includes high-quality bonds that can support your “sleep at night” needs without overfunding cash.

4. Missed Windfalls

- Gifts, inheritances, bonuses, scholarships, and other windfalls are opportunities to accelerate your plan.

- We routinely see siblings or peers take very different paths with the same windfall—with dramatically different outcomes over their lifetimes.

- Directing windfalls toward debt reduction, savings, or investment can permanently improve your trajectory.

5. Chasing Illiquidity and Complexity

- The financial industry often markets complexity as sophistication.

- Illiquid, opaque, or overly complex investments can stall your net worth growth and complicate your financial life.

What feels “stable” because you don’t see daily pricing can become a headache when you need liquidity, flexibility, or when you enter the estate planning phase.

The list doesn’t end there, but the theme is consistent: focus on the levers you can pull today (planning), not on predicting markets tomorrow (reacting). By paying attention to your savings, spending, use of cash, treatment of windfalls, and the simplicity and liquidity of your investments, you can meaningfully improve your family’s net worth over time.

Net worth is the scoreboard of your financial life. Markets will always move up and down, but your plan—and how you behave around it—is what ultimately determines your long-term success. Let’s toast to the new year and your family’s net worth!